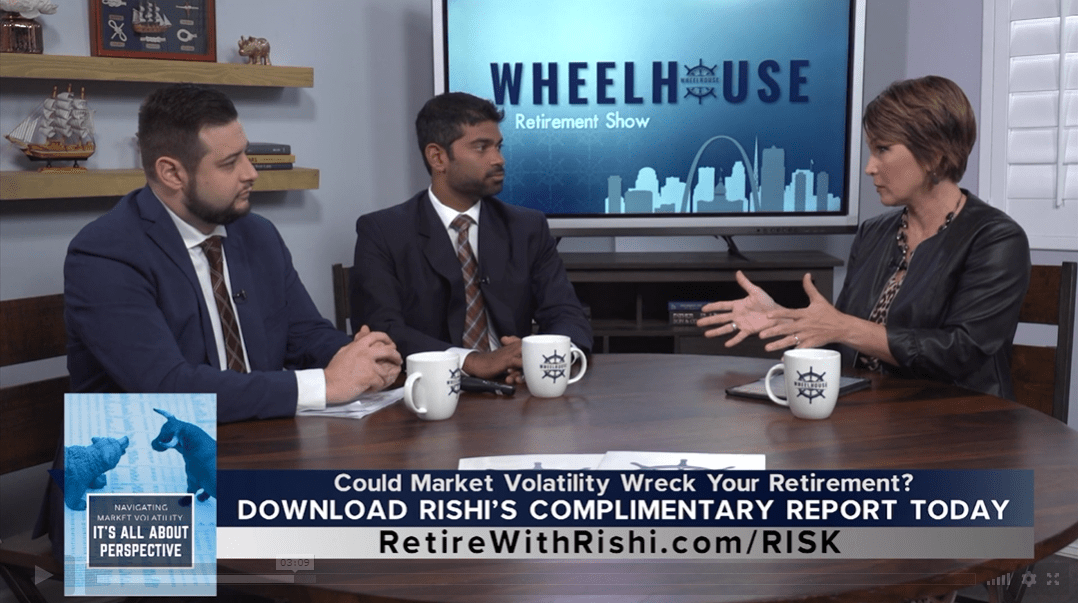

Watch Rishi Ghosh on KMOV Channel 4!

Get more retirement guidance from Wheelhouse Advisory Group by tuning into The Wheelhouse Retirement Show each week on Saturday nights at 6:30pm on CBS and Sunday nights at 11:00PM on CBS on KMOV Channel 4.

The Wheelhouse Retirement Show is a paid advertisement.

Get a sneak preview:

Tv Episode 38

Episode 38:

- Changes for the Distribution Phase

- The Right Time to Consolidate Accounts

- Donor Advised Funds

Tv Episode 37

Episode 37:

- Steps to Retire Early

- Accessing Retirement Accounts Before Age 59.5

- Tax Strategies for RMDs

Tv Episode 36

Episode 36:

- Required Minimum Distributions

- Section 1202

Tv Episode 35

Episode 35:

- Optimizing Your Income Valley

- Qualified Opportunity Zone Investing

Tv Episode 34

Episode 34:

- Special Guest Marty Ruby

- Tax Allocations of Your Retirement Funds

- Philanthropic Goals

TV Episode 33

Episode 33:

- Special Guest Marty Ruby

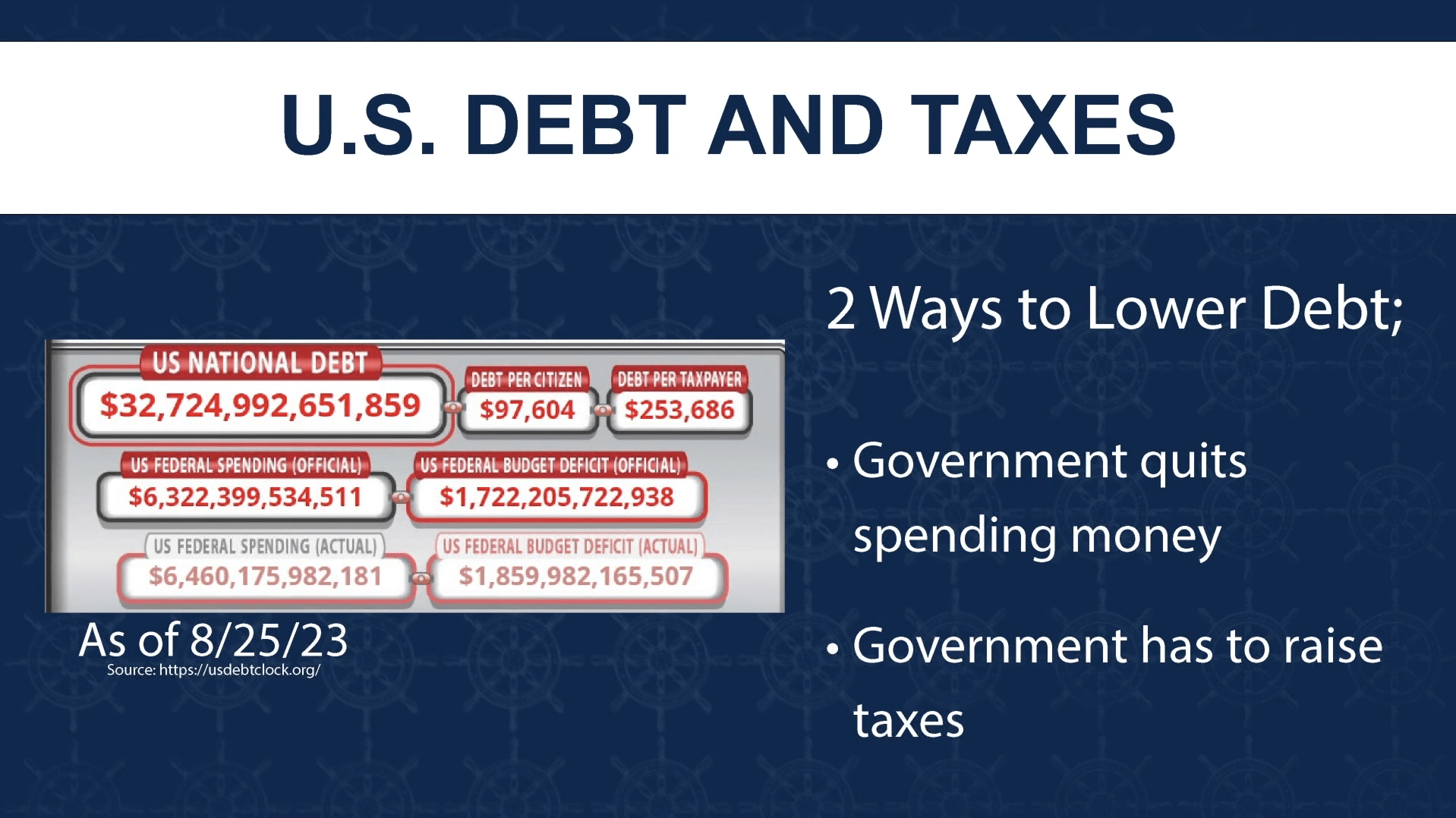

- Legislative Risks

- Tax Bill in Retirement

- Grantor Retained Annuity Trust

TV Episode – 32

Episode 32:

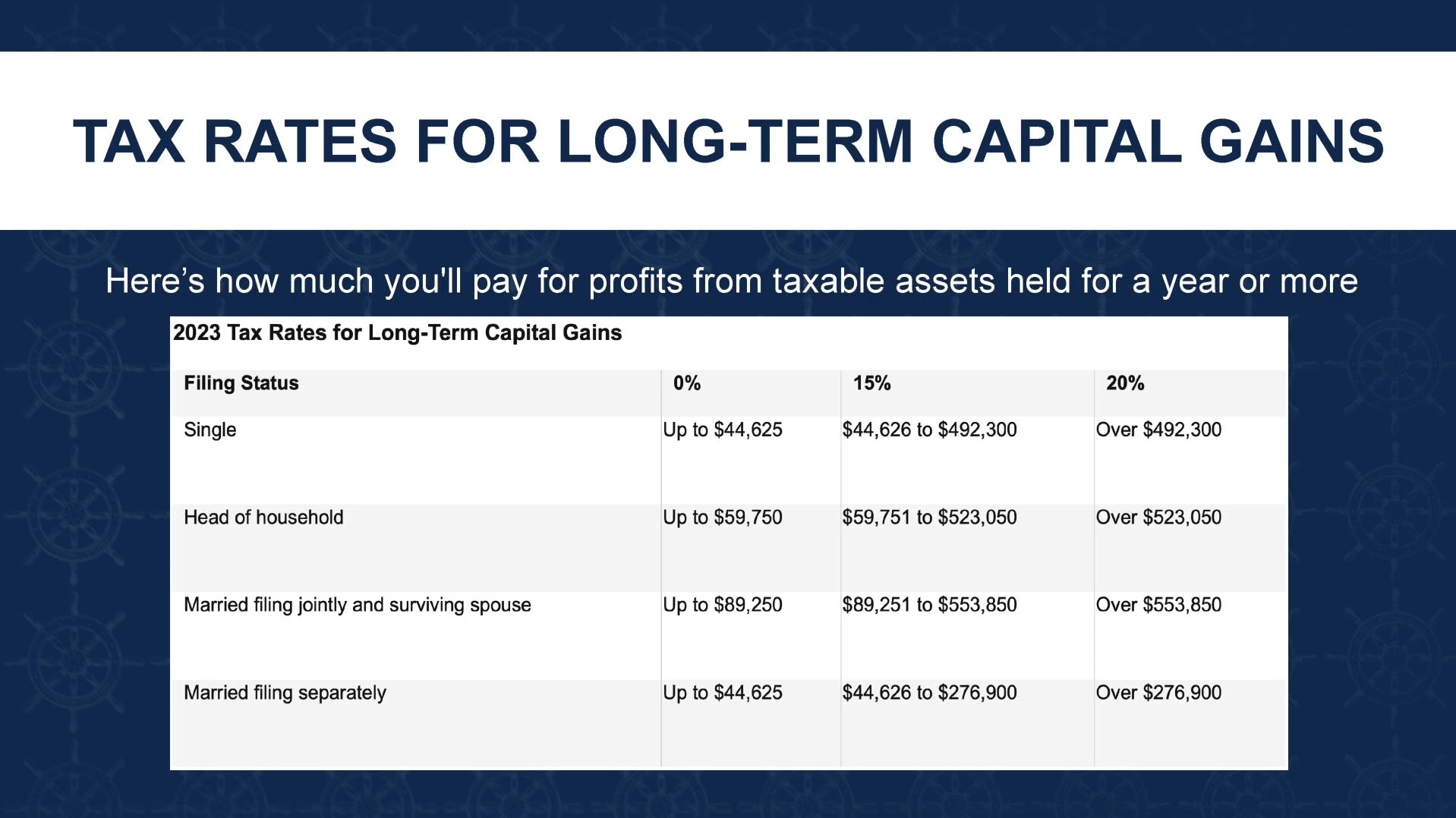

- Capital Gains Taxes

- Generation Skipping Transfer Tax

- Health Savings Accounts

TV Episode – 31

Episode 31:

- Inverted Yield Curve

- Avoiding Large Portfolio Hits in Early Retirement

- Pros and Cons of Buffered ETFs

TV Episode – 30

Episode 30:

- Higher interest rates impact on your retirement

- What you need to know about federal spending

- Pros and cons of investing in target date funds

TV Episode – 29

Episode 29:

- What lessons can we learn from past recessions

- Tips to help your income keep pace with inflation

TV Episode 28

Episode 28:

- Tips for taking advantage of historically low tax rates

- Taxes on your Social Security income

- Charitable Remainder Trusts (CRTs)

TV Episode 27

Episode 27:

- Components of a Comprehensive Retirement Plan

- Your Income in Retirement

- SECURE Act 2.0

TV Episode 26

Episode 26:

- Healthcare in Retirement

- Basics of Medicare

- IRMAA and Tax Planning

- Long-Term Care in Retirement

TV Episode 25

Episode 25:

- Your Spending in Retirement

- Understanding Your Withdrawal Rate

- 5 Potential Speedbumps of Your Retirement

TV Episode 24

Episode 24:

- Rising Interest Rates

- Bonds

- Inflation

- TIPS (Treasury Inflation Protected Securities

TV Episode – 23

Episode 23:

- 3 Tax Classifications of Various Accounts

- Real Net Worth vs Paper Net Worth

- Married Filing Jointly vs Single Filing

- Tax-Loss Harvesting

TV episode 22

Episode 22:

- Special Guest Marty Ruby

- Tax Deferred Plans

- "The No Compromise Retirement Plan" - The tax implications of how you save

- Tax Code: Section 7702

- Indexed Universal Life Insurance

TV episode 21

Episode 21:

- Special Guest Marty Ruby

- Tax Deferred Plans and a macro view on taxes

- "The New Holistic Retirement" - Understanding tax and legislative risk in your portfolio

- Tax Rule 72(t)

- Indexed Universal Life Insurance

TV Episode 20

Episode 20:

- The 3 pillars of Total Retirement Planning

- Proactive tax planning strategies

- Social Security taxation

- Components of a well-written retirement plan

TV Episode 19

Episode 19:

- Legislative Action - Will how your money is taxed change?

- The SECURE Act

- Long-Term Care and Medical Expenses

TV Video #18

Episode 18:

- 4 Keys to a Comfortable Retirement

- Options For Your Old 401(k)

- The Wheelhouse Process

TV Video #17

Episode 17:

- Combating Inflation

- Maximizing Social Security benefits

- 4 Bucket Investment Strategy

TV Video #16

Episode 16:

- Empowering female investors

- Tailoring old investments to new goals

- Ask the Advisor

TV Video #15

Episode 15:

- Unexpected early retirements

- Proactive tax planning and health insurance costs

- Reducing your RMD tax bills

TV Video #14

Episode 14:

- Prepping for a market correction

- Taxes: Why your retirement lifestyle may be in jeopardy

- Resisting the urge to play Wall Street roulette

- Ready to Take -The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.