Written by: Anthony Striker, MBA – Senior Wealth Manager

You may have heard, it’s an election year! One of the most common questions Wheelhouse advisors get during election years is “What can we expect from the stock market during an election year?” In our opinion, it is important to remember that capital markets are non-partisan and run on market demand, but it certainly can be interesting to study market history when it comes to the years preceding an election. Below are a few insights on market history during election years:

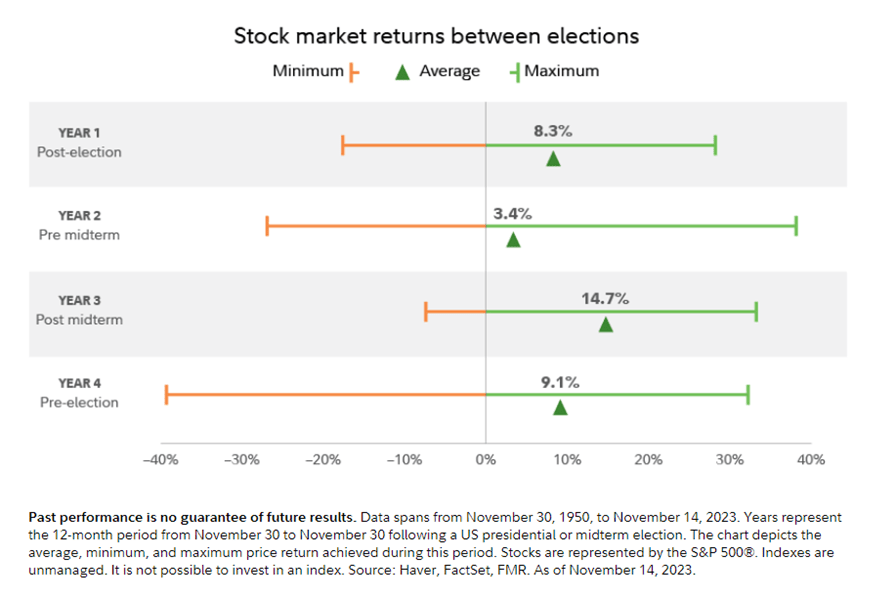

- While US markets have generally risen during election years, they also produce the widest range of return outcomes. On average, the US stock market has averaged returns of 9.1% in election years over the last 70 years. However, Denise Chisolm, director of quantitative market strategy for Fidelity, remarks that “the 12 months preceding a presidential election have had the widest range of possible market outcomes relative to other parts of the election cycle, the average return isn’t substantially better or worse”. This tells us that while volatility may certainly strike during an election year, there is truly no telling whether that may mean an upward or downward trend during the volatility.

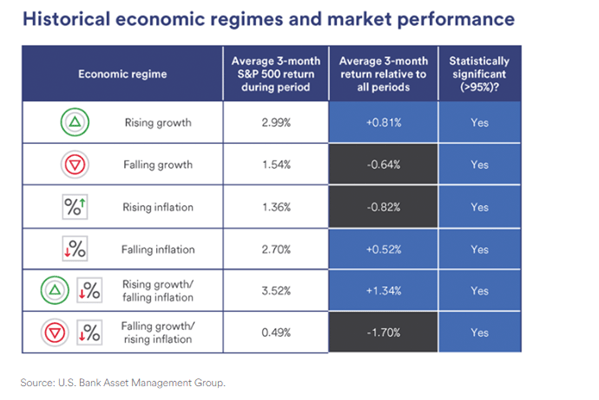

- Inflation and economic growth may be more telling than election outcomes when it comes to the stock market’s performance. US Bank’s research tells us that “rising economic growth and falling inflation have been associated with returns that are considered above long-term averages while falling growth and rising inflation have corresponded to positive but below average market returns.” They have provided a chart to drive home that these patterns may be more pressing to stock market performance, in any year, not just election years (See Image 2.0 below):

- When a president seeks reelection, we sometimes see fiscal stimulus and fiscal growth measures taken, which can boost the stock market. While this may be true in many reelection years, US News claims that “Biden may have limited opportunities to add economic stimulus measures in 2024”. This is largely due to the split in Congress and Republicans controlling the House of Representatives.

- Short-term market volatility can be seen if a major shift in polls is observed. I remember watching election coverage on the eve of the Trump/Clinton election in 2016. Many expected Clinton to take a victory, and as Trump started to gain votes within the electoral college, Dow futures fell over 800 points in aftermarket trading. As it became more solidified in the morning that Trump/Pence would be taking the White House, markets calmed down and opened only 190 points down on November 9th, 2016. This short-term volatility can point to traders expecting certain sectors to outperform with one person as president, and a shift out of those sectors and into different ones if it becomes apparent that their opponent may win.

- Short-term market volatility can be seen if a major shift in polls is observed. I remember watching election coverage on the eve of the Trump/Clinton election in 2016. Many expected Clinton to take a victory, and as Trump started to gain votes within the electoral college, Dow futures fell over 800 points in aftermarket trading. As it became more solidified in the morning that Trump/Pence would be taking the White House, markets calmed down and opened only 190 points down on November 9th, 2016. This short-term volatility can point to traders expecting certain sectors to outperform with one person as president, and a shift out of those sectors and into different ones if it becomes apparent that their opponent may win.

Hopefully, you are not surprised by this, but Wheelhouse continues to take the “control what you can control” approach and a long-term focus when we are asked specific questions by clients and prospects about election years and the stock market. The average retirement is a little over 18 years. That means you will see 4 or 5 election cycles throughout your retirement. It is important to know that these election years are by no means a “make or break” year when it comes to portfolio performance, as most data shows, there is not a clear connection between the outcome of a presidential election and market performance.

Through times of potential volatility and heightened uncertainty, I find it most important to consider a “worst case” scenario of a 50% market drop. How would that affect your portfolio from a numbers perspective? How would it affect you and your family from an emotional and mental perspective? Our goal is to set our clients up so they have opportunity and security during market volatility, whether it is an election year or not. This all comes back to making sure you have enough of your assets protected through “safe money” so that you are taking a reasonable amount of risk with good quality growth funds in the stock market. In other words, we believe that protecting the majority of your nest egg is important so that when the market does drop, the funds you need to spend in the next 5-10 years are protected from loss AND you can have the conversation of shifting funds to growth when the market is down and buying stocks on sale.

As I say often in meetings with clients, “life doesn’t stop in retirement”. That includes election years and cycles. If you have any questions about how your current plan may be affected by market volatility from the election, or you are interested in working with Wheelhouse to build your holistic retirement plan, give our team a call!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.